Market Outlook

February 28, 2018

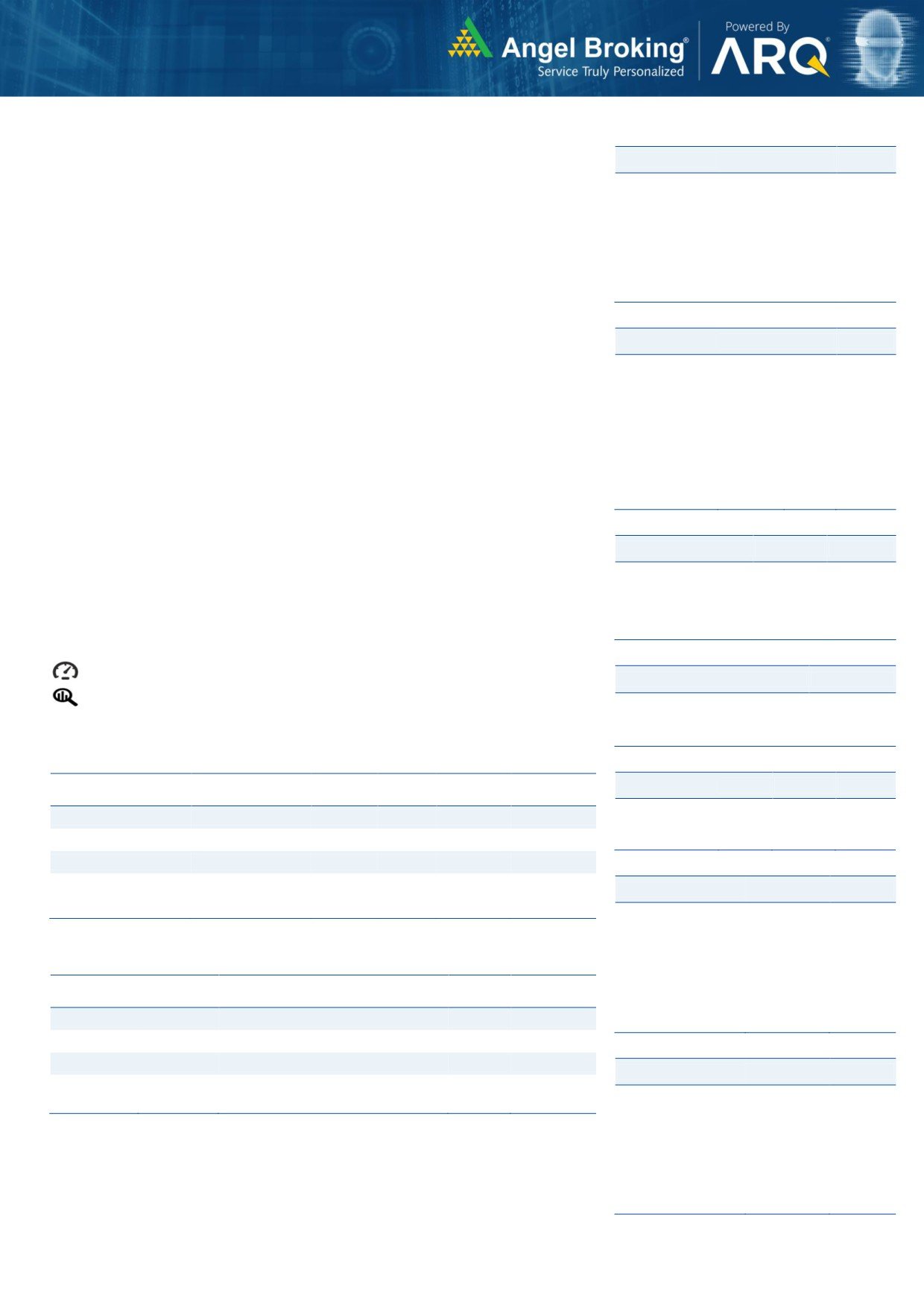

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open negative tracking global indices and SGX Nifty.

BSE Sensex

(0.3)

(99)

34,346

US stocks came under pressure over the course of the trading day after initially

Nifty

(0.3)

(28)

10,554

showing a lack of direction. The pullback on the day came after the major averages

Mid Cap

(0.5)

(84)

16,601

moved sharply higher over the two previous sessions. The Dow Jones ended on a

Small Cap

(0.4)

(64)

18,090

downside front of 1.2% to close at 25,410 and the Nasdaq Composite edged down

Bankex

(1.4)

(414)

28,587

to 1.2%, to 7,330.

U.K. shares were modestly higher after house builder Persimmon delivered an

Global Indices

Chg (%)

(Pts)

(Close)

"excellent" performance in 2017 and Comcast Corp, the biggest cable operator in

Dow Jones

(1.2)

(299)

25,410

the United States, offered to pay $31 billion to buy Sky Plc. The FTSE 100 was ended

Nasdaq

(1.2)

(91)

7,330

on a downside front of 0.1% at 7,282.

FTSE

(0.1)

(7)

7,282

On domestic front, Indian shares opened higher as investors kept an eye on the

Nikkei

(0.4)

(97)

22,293

GDP data for December quarter due on Wednesday and new Fed Chairman Jerome

Hang Seng

(1.1)

(349)

30,919

Powell's congressional hearings. The Sensex ended on a downside front of 0.3% at

Shanghai Com

(0.8)

(28)

3,264

34,346 while the Nifty ended at 10,554 with a downside of 0.3%.

News Analysis

Advances / Declines

BSE

NSE

GIC to pick 40% stake in Prestige's Exora Business Park for Rs 26bn

Advances

997

620

Declines

1,768

1,177

Detailed analysis on Pg2

Unchanged

135

57

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Volumes (` Cr)

Stock Watch: Latest investment recommendations on 150+ stocks

BSE

3,234

Refer Pg5 onwards

NSE

28,193

Top Picks

CMP

Target

Upside

Net Inflows (` Cr)

Net

Mtd

Ytd

Company

Sector

Rating

(`)

(`)

(%)

FII

(1,115)

(9,898)

3,086

Blue Star

Capital Goods

Buy

742

867

16.9

Dewan Housing Finance

Financials

Buy

582

712

22.3

*MFs

1,466

11,572

20,595

Century Plyboards

Forest Products

Buy

326

400

22.8

Navkar Corporation

Other

Buy

169

265

56.8

Top Gainers

Price (`)

Chg (%)

KEI Industries

Capital Goods Accumulate

380

436

14.7

ASTRAL

870

7.4

More Top Picks on Pg4

SYMPHONY

1787

5.8

Key Upcoming Events

DMART

1354

5.0

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

INDHOTEL

139

4.5

Feb27

Euro Zone Euro-Zone Consumer Confidence

0.10

0.10

WABCOINDIA

7796

4.0

Feb27

Germany Unemployment change (000's)

(24.00)

(15.00)

Feb28

US

Consumer Confidence

125.40

126.40

Top Losers

Price (`)

Chg (%)

Feb28

China

PMI Manufacturing

51.30

51.20

Feb28

Germany

PMI Manufacturing

60.30

60.30

PNB

98

-12.1

More Events on Pg7

BANKINDIA

118

-7.2

IDBI

74

-6.8

RNAVAL

41

-6.3

OBEROIRLTY

527

-5.8

As on February 27 2018

Market Outlook

February 28, 2018

News Analysis

GIC to pick 40% stake in Prestige's Exora Business Park for Rs 26bn

Singaporean sovereign wealth fund GIC has agreed to invest around Rs 26 billion

in real estate firm Prestige Estates' subsidiary Exora Business Park for a

consideration of up to 40 per cent stake.

The Bengaluru-based developer entered into a preliminary term sheet with GIC's

subsidiary Reco Jade Ind (Reco) to sell a minority stake in its subsidiary. Exora

Business Park owns, directly or indirectly, many operating and under-construction

office properties of the developer. It has a portfolio of five projects with over 8.5

million sqft of development, of which 5.5 million sqft is completed and under-

construction.

Economic and Political News

Yogi Adityanath to revive sick industrial units to boost investment in UP

AIIB approves $1.5-bn in loans to India for infrastructure projects

FinMin gives nod to scrap vehicles over 15 yrs, policy to go to GST Council

India-South Korea bilateral trade touched $20bn in 2017

Corporate News

India, Japan major contributors to 0.8% rise in world steel output

Reliance, Samsung to bring 4G connectivity to 99% of population by Diwali

Trai to order Aircel to maintain service quality, grant codes for port outs

Airtel, Google partner to offer low-cost 4G smartphones, to take on Jio

Market Outlook

February 28, 2018

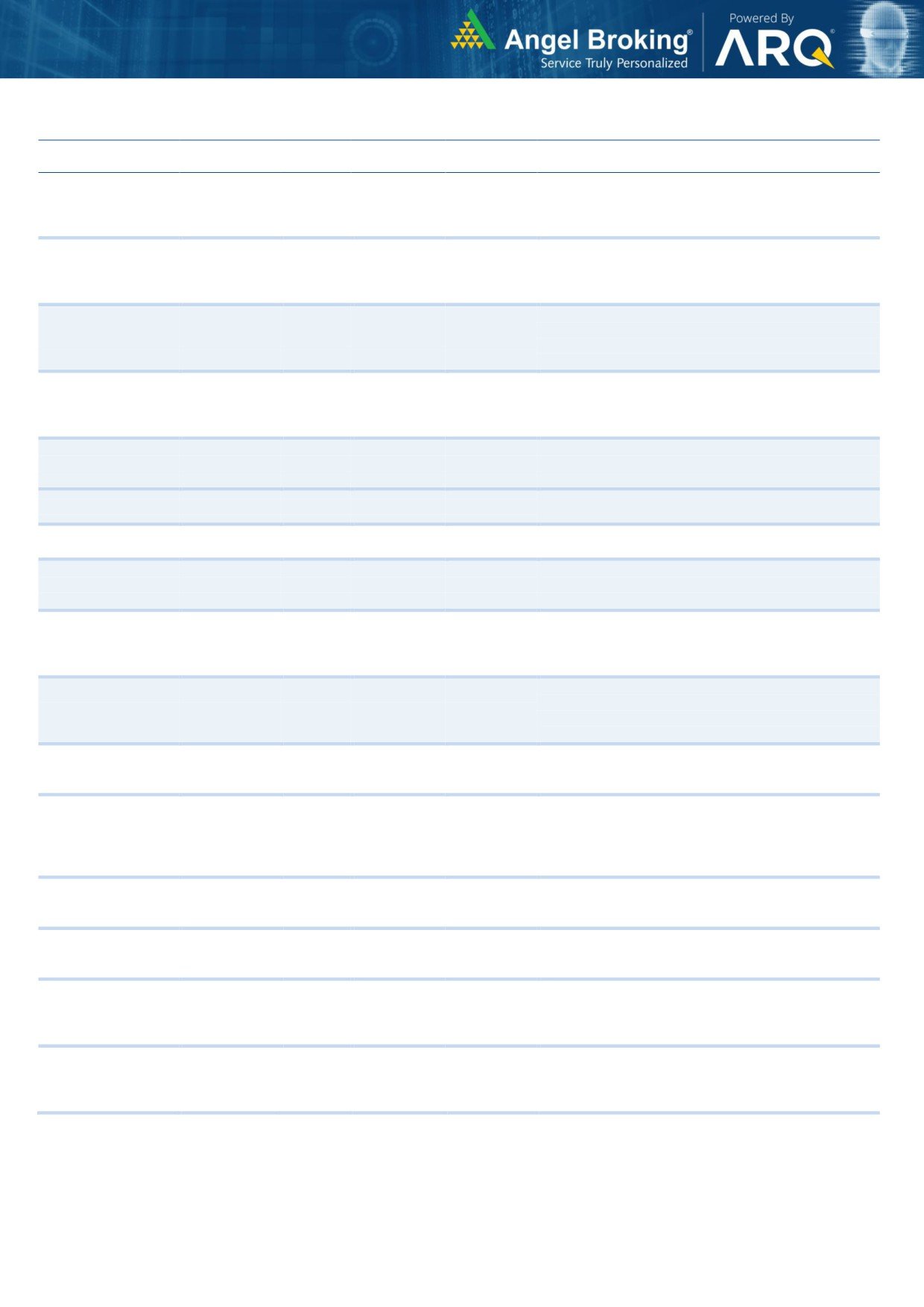

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leade`hip

in acute therapeutic segment. Alkem expects to launch

Alkem Laboratories

26,442

2,232

2,441

9.4

more products in USA, which bodes for its international

business.

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the

Blue Star

7,119

733

867

18.3

market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

18,267

563

712

26.5

presence in tier-II & III cities where the growth

opportunity is immense.

Loan growth is likely to pick up after a sluggish FY17.

Lower credit cost will help in strong bottom-line growth.

Karur Vysya Bank

8,020

109

160

44.9

Increasing share of CASA will help in NIM

improvement.

High order book execution in EPC segment, rising B2C

KEI Industries

2,980

383

436

13.8

sales and higher exports to boost the revenues and

profitability

Expected to benefit from the lower capex requirement

Music Broadcast

2,179

383

475

24.3

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage

Navkar Corporation

2,544

169

265

56.8

at ICD as well CFS augur well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

3,047

654

851

30.1

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no.

2

viewership ranking in English news genre, exit from the

TV Today Network

2,716

446

508

13.9

radio business, and anticipated growth in ad spends by

corporate to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The Gujarat

Maruti Suzuki

2,71,926

8,891

10,619

19.4

plant will also enable higher operating leverage which

will be margin accretive.

We expect loan book to grow at 24.3% over next two

GIC Housing

2,185

401

655

63.3

year; change in borrowing mix will help in NIM

improvement

We expect CPIL to report net Revenue/PAT CAGR of

~17%/16% over FY2017-20E mainly due to healthy

7,237

329

400

21.5

growth in plywood & lamination business, forayed into

Century Plyboards India

MDF & Particle boards on back of strong brand &

distribution network.

We expect sales/PAT to grow at 13.5%/20% over next

LT Foods

3,045

95

128

34.5

two years on the back of strong distribution network &

addition of new products in portfolio.

We expect financialisation of savings and increasing

Aditya Birla Capital

36118

167

230

37.7

penetration in Insurance & Mutual fund would ensure

steady growth.

Third largest brand play in luggage segment Increased

product offerings and improving distribution network is

Safari Industries

1180

530

650

22.4

leading to strong growth in business. Likely to post

robust growth for next 3-4 years

We expect HSIL to report PAT CAGR of ~15% over

FY2017-20E owing to better improvement in operating

HSIL

3094

436

510

16.9

margin due price hike in container glass segment,

turnaround in consumer business.

Source: Company, Angel Research

Market Outlook

February 28, 2018

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

3,911

298

360

20.1

over FY18-20 backed by capacity expansion and new

geographical foray

We forecast Nilkamal to report top-line CAGR of ~9%

to `2,635cr over FY17-20E on the back of healthy

Nilkamal

2,529

1,699

2,178

28.2

demand growth in plastic division. On the bottom-line

front, we estimate ~10% CAGR to `162cr owing to

improvement in volumes.

We expect sales/PAT to grow at 9%/14% over next two

years on the back of healthy demand growth in

Shreyans Industries

222

158

247

56.3

printing. Further, China had banned making paper

from waste pulp which would benefit Indian paper

companies.

The prism has diversified exposure in the different

segment such as Cement, Tile & ready mix concrete.

Prism Cement

6,410

122

160

31.2

Thus we believe, PCL is in the right place to capture

ongoing government spending on affordable housing

and infrastructure projects.

Source: Company, Angel Research

Market Outlook

February 28, 2018

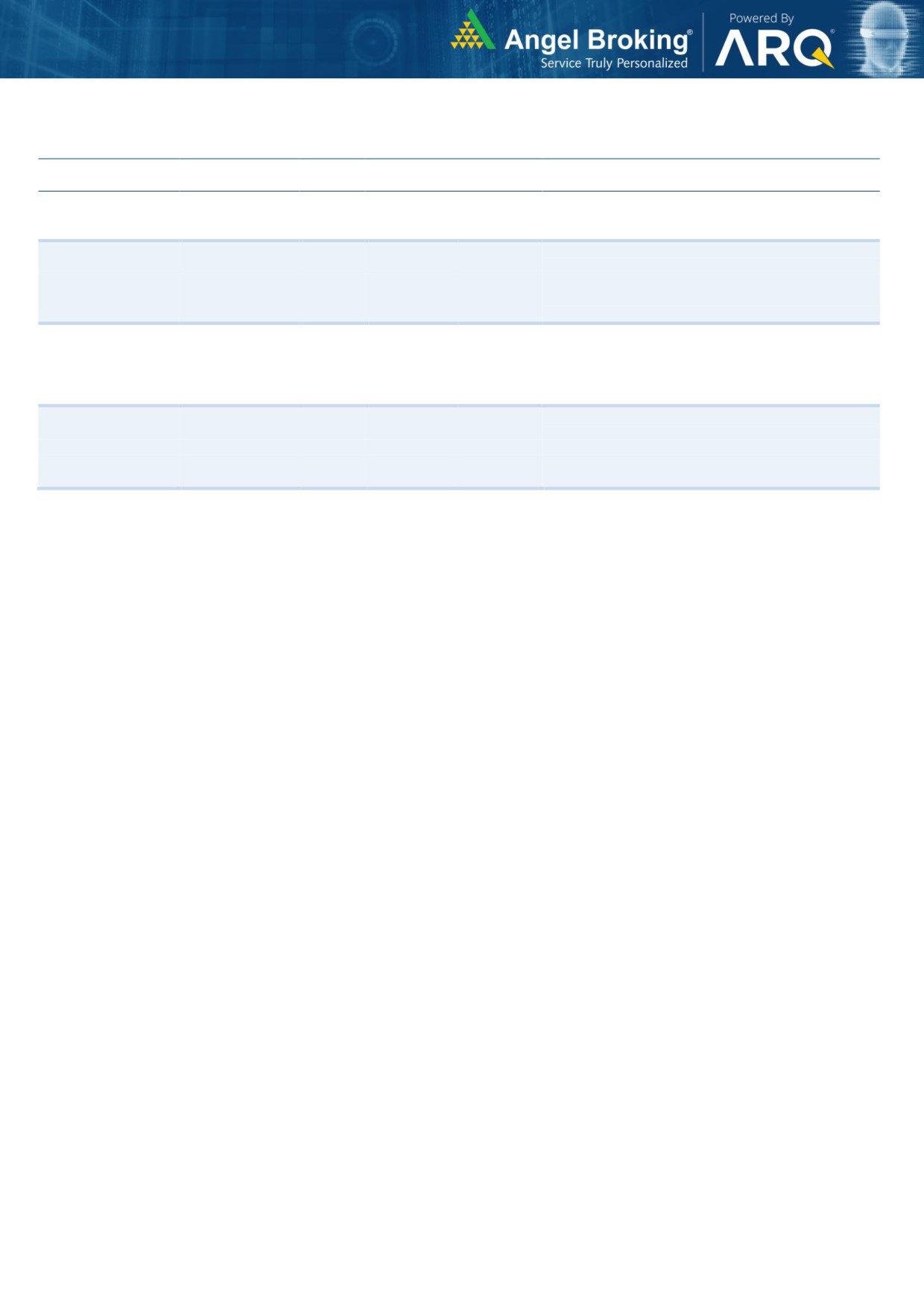

Key Upcoming Events

Global economic events release calendar

Bloomberg Data

Date

Time Country

Event Description

Unit

Period

Last Reported

Estimated

Feb 28, 2018

8:30 PMUS

Consumer Confidence

S.A./ 1985=100

Feb

125.40

126.40

6:30 AMChina

PMI Manufacturing

Value

Feb

51.30

51.20

2:25 PMGermany

PMI Manufacturing

Value

Feb F

60.30

60.30

Mar 01, 2018

7:00 PMUS

GDP Qoq (Annualised)

% Change

4Q S

2.60

2.50

7:00 PMUS

Initial Jobless claims

Thousands

Feb 24

222.00

226.00

3:00 PMUK

PMI Manufacturing

Value

Feb

55.30

55.00

Mar 05, 2018

2:25 PMGermany

PMI Services

Value

Feb F

55.30

Mar 07, 2018

3:30 PMEuro Zone

Euro-Zone GDP s.a. (QoQ)

% Change

4Q F

0.60

Mar 08, 2018

China

Exports YoY%

% Change

Feb

11.10

6:15 PMEuro Zone

ECB announces interest rates

%

Mar 8

-

Mar 09, 2018

3:00 PMUK

Industrial Production (YoY)

% Change

Jan

-

7:00 AMChina

Consumer Price Index (YoY)

% Change

Feb

1.50

7:00 PMUS

Change in Nonfarm payrolls

Thousands

Feb

200.00

195.00

7:00 PMUS

Unnemployment rate

%

Feb

4.10

4.00

Mar 12, 2018

6:00 PMUS

Consumer price index (mom)

% Change

Feb

0.50

Mar 13, 2018

5:30 PMIndia

Industrial Production YoY

% Change

Jan

7.10

Mar 14, 2018

12:00 PMIndia

Monthly Wholesale Prices YoY%

% Change

Feb

2.84

US

Producer Price Index (mom)

% Change

Feb

0.70

Mar 15, 2018

India

Imports YoY%

% Change

Feb

26.10

India

Exports YoY%

% Change

Feb

9.10

Mar 16, 2018

3:30 PMEuro Zone

Euro-Zone CPI (YoY)

%

Feb F

1.30

6:45 PMUS

Industrial Production

%

Feb

(0.05)

6:00 PMUS

Housing Starts

Thousands

Feb

1,326.00

6:00 PMUS

Building permits

Thousands

Feb

1,396.00

Source: Bloomberg, Angel Research

Market Outlook

February 28, 2018

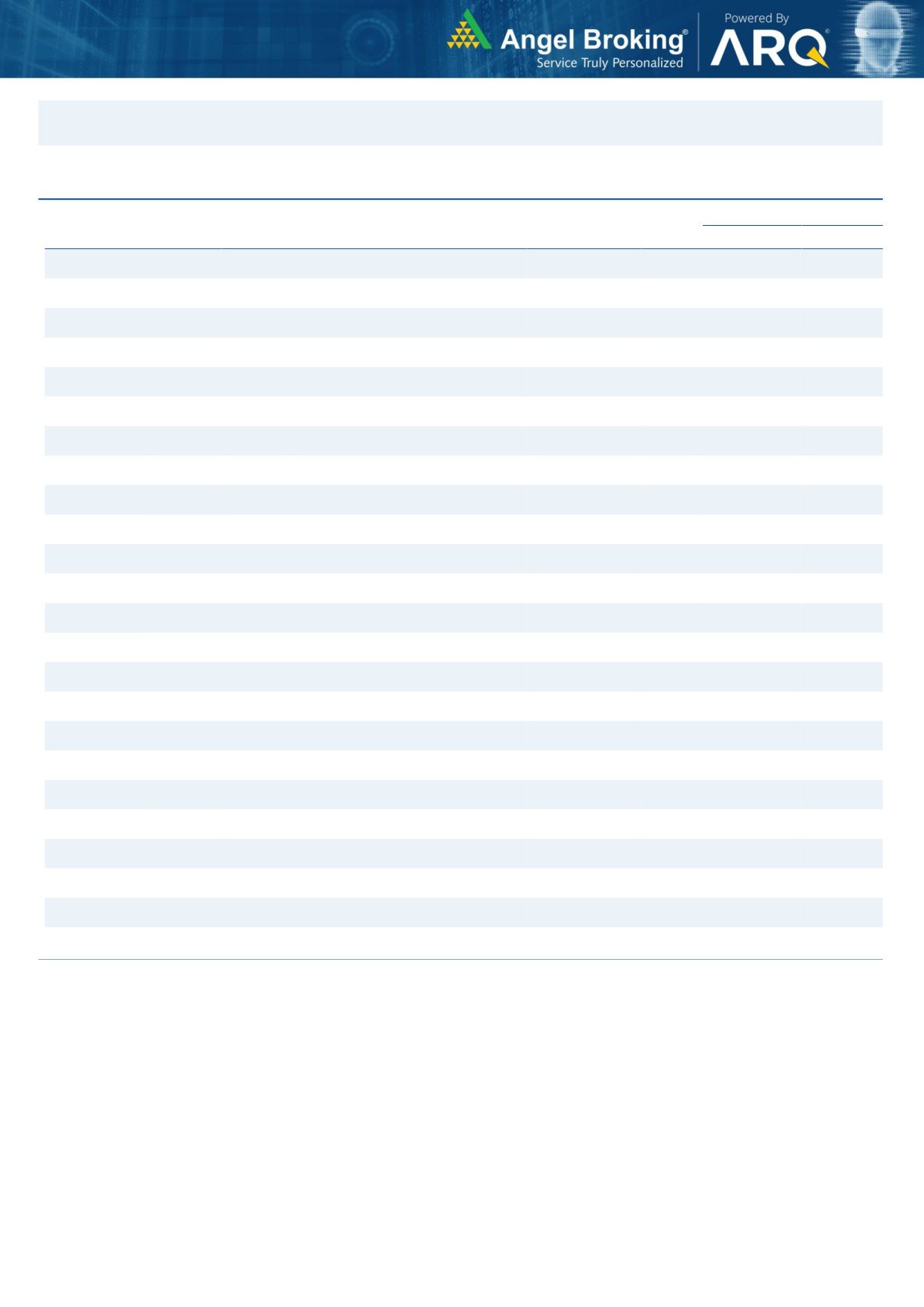

Macro watch

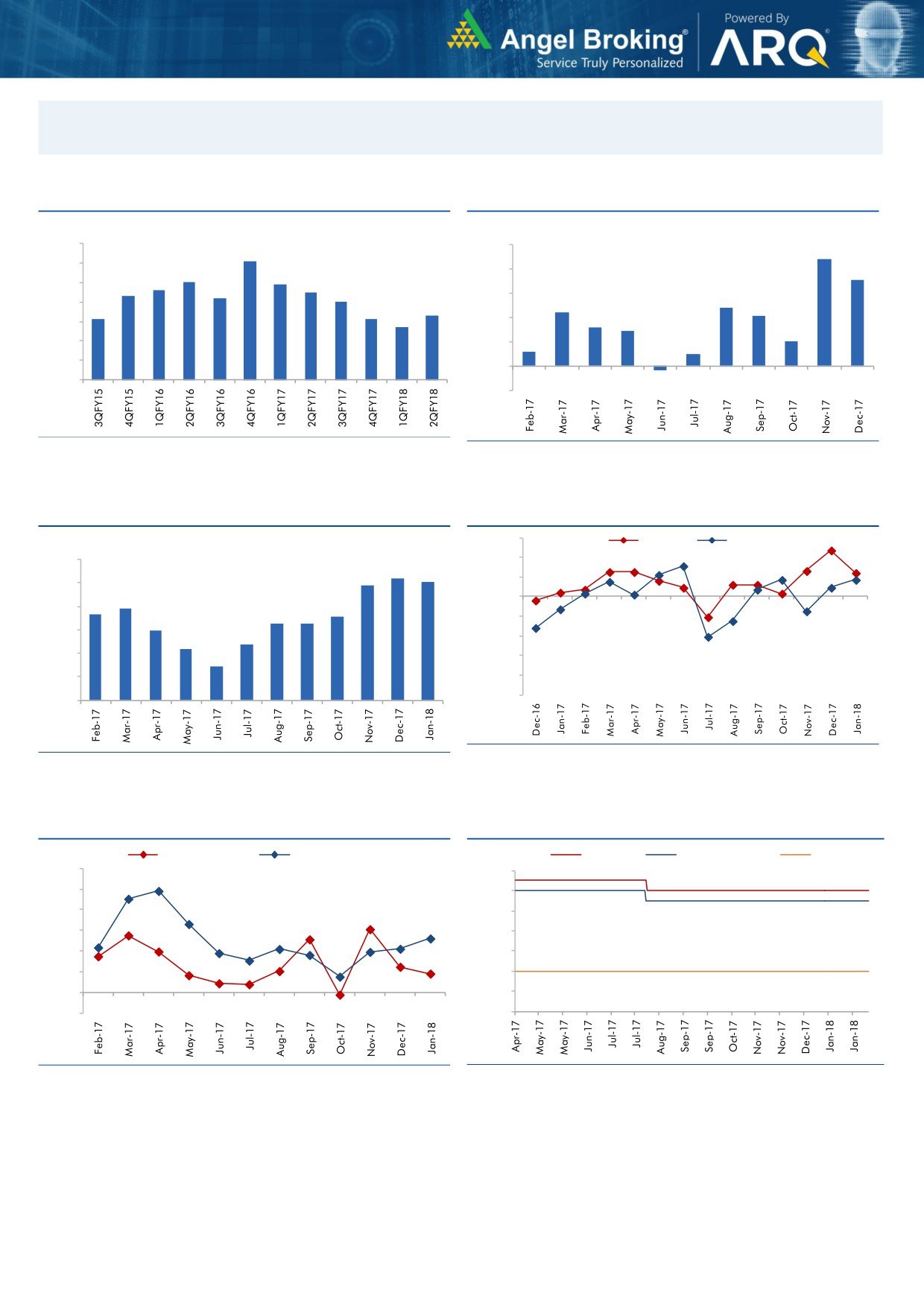

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

10.0

9.1

8.8

9.0

8.0

7.1

8.0

7.9

7.6

7.5

8.0

7.3

7.2

7.0

6.0

4.8

7.0

6.3

4.4

4.1

6.1

6.1

5.7

4.0

3.2

2.9

6.0

2.0

5.0

2.0

1.2

1.0

4.0

-

3.0

(0.3)

(2.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

5.1

4.9

52.0

5.0

3.9

50.0

3.7

3.6

4.0

3.3

3.3

3.0

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

5.00

20.0

4.50

10.0

4.00

0.0

3.50

(10.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

February 28, 2018

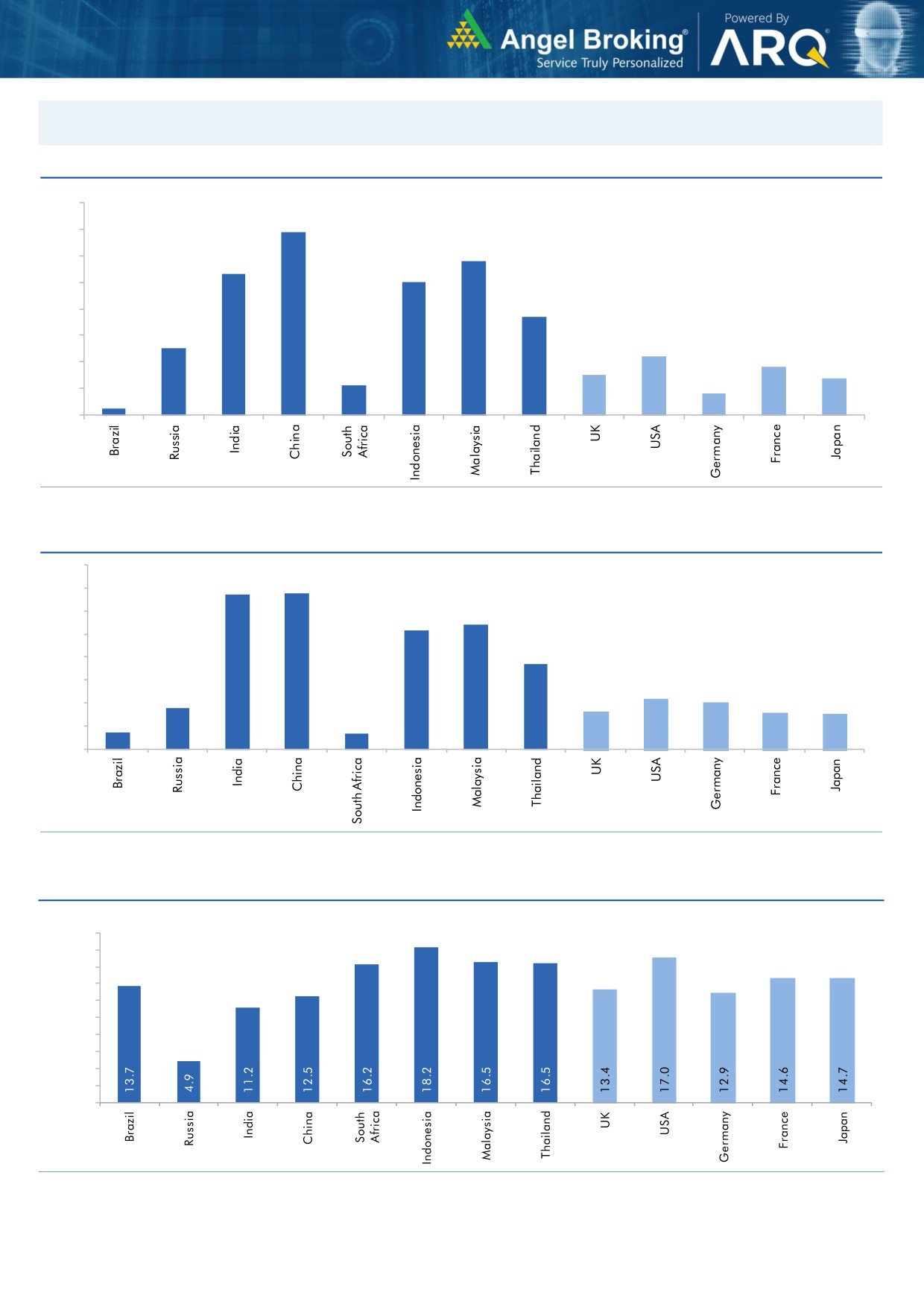

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

February 28, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

86,935

7.8

16.5

28.2

Russia

Micex

2,342

0.9

9.0

13.9

India

Nifty

10,554

(4.8)

1.6

18.2

China

Shanghai Composite

3,292

(6.8)

(4.8)

0.8

South Africa

Top 40

52,034

(4.6)

(3.6)

16.7

Mexico

Mexbol

47,970

(5.5)

(0.3)

1.3

Indonesia

LQ45

1,104

(2.6)

8.0

22.7

Malaysia

KLCI

1,871

1.8

8.8

9.6

Thailand

SET 50

1,206

1.4

10.6

21.8

USA

Dow Jones

25,410

(3.7)

8.0

22.1

UK

FTSE

7,282

(5.0)

(1.7)

(1.4)

Japan

Nikkei

22,390

(5.4)

(0.1)

16.3

Germany

DAX

12,491

(6.4)

(4.4)

5.5

France

CAC

5,344

(3.3)

(0.9)

7.0

Source: Bloomberg, Angel Research p68in4

Market Outlook

February 28, 2018

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.